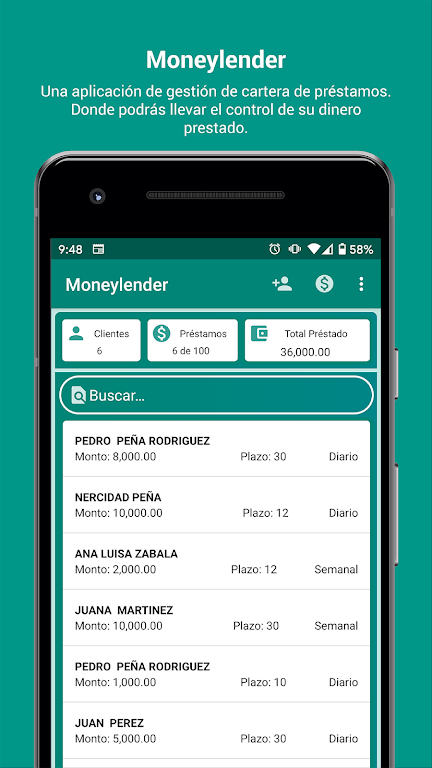

Moneylender ( Préstamos ) is a powerful and user-friendly Loan Management application designed to streamline and simplify your lending process. With a wide range of features, Moneylender puts you in control of your borrowed money. Whether you are a professional money lender or just lend occasionally, this app is your best option. Easily create customer profiles, set different loan terms (daily, weekly, biweekly, monthly), and choose from various loan amortization options. Keep track of your income and consult your cash register effortlessly.

Features of Moneylender ( Préstamos ):

Customer Creation: Moneylender allows you to create a customer database where you can store all the necessary information about borrowers, making it easy to keep track of their loan history and contact details.

Creation of Branches: If you have multiple branches or locations, Moneylender allows you to create and manage them all in one place, simplifying your loan management process.

Configure Business Profile: Personalize your loan business by adding your business name, slogan, telephone number, and address to give it a professional touch and easily share your contact information with borrowers.

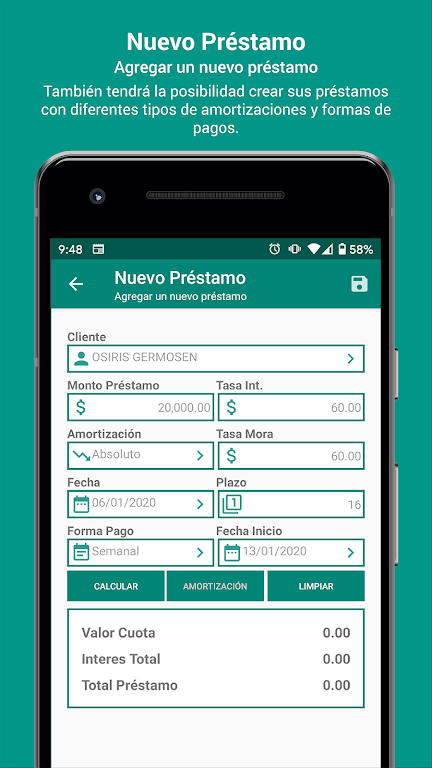

Flexible Loan Options: Moneylender offers various loan frequency options, including daily, weekly, biweekly, and monthly, giving you the flexibility to choose the repayment schedule that suits you and your borrowers.

Amortization Options: Customize the loan amortization method according to your preference. Moneylender offers absolute, unpaid, fixed capital, and maturity options, ensuring you have full control over how the loan is repaid.

Tips for Users:

Keep your customer database updated: Regularly update the customer information in the app to have accurate records of borrowers and their loan details.

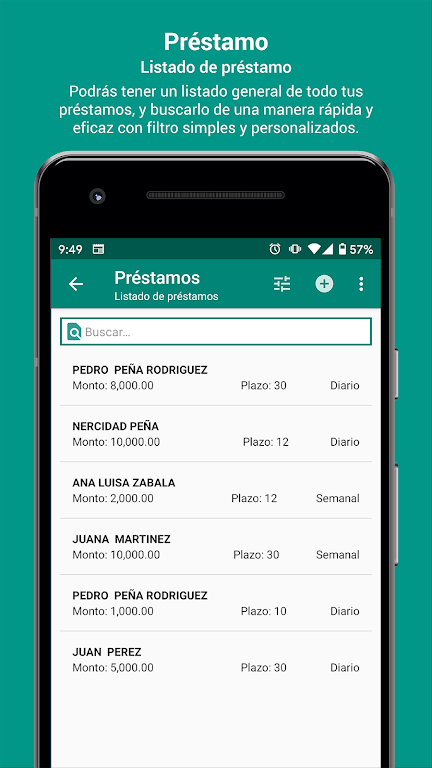

Utilize the advanced search feature: Use the advanced loan search option to quickly find specific loan records based on criteria such as borrower name, loan amount, or repayment date.

Monitor cash flow with the cash register: Use the cash register feature to monitor your daily, weekly, or monthly cash flow, ensuring you have a clear overview of your loan business's financial health.

Stay organized with income receipts: Create and store income receipts within the app to keep track of loan repayments and income. This helps in maintaining accurate financial records for future reference.

Analyze loan interest with projection graphs: Make use of the interest projection graph to visualize projected, collected, uncollected, and past due interest. This feature helps you monitor the overall interest earnings and identify any potential issues with loan repayments.

Conclusion:

Moneylender ( Préstamos ) offers a range of features to help you streamline and control your lending activities. From creating a customer database to customizing loan options and monitoring cash flow, this app provides everything you need to efficiently manage your loans. With its user-friendly interface and advanced features like receipt printing and interest projection graphs, Moneylender is the ultimate tool for borrowers looking to optimize their lending business. Download Moneylender today and take full control of your borrowed money.